Estimated reading time: 5 minutes

In what could be mistaken for a skit from the Keystone Cops of fiscal policy, we’ve got a report so shocking that it actually makes your average conspiracy theory look like child’s play. Apparently, someone who must have gotten their economics degree from a claw machine is ‘open’ to the idea of cutting taxes—oh, but not just any taxes.

We’re talking about the very ones that keep Social Security and Medicare from turning into nothing more than an elaborate Ponzi scheme. Now, isn’t that just the kind of forward-thinking initiative we’ve all been holding our breaths for?

The Breakdown

- Let’s Rob Grandma and Call It Innovation: So, the brilliant plan is to slash taxes that fund Social Security and Medicare because, why not do the exact opposite of what any sane person would consider sensible? After all, who needs a safety net when you’re plummeting to the ground?

- Specifics: While kids are busy saving up for the latest video game, the masterminds in charge think it’s playtime with the nation’s piggy bank. The proposed cuts would reduce revenue for programs that—brace yourself—actually benefit people, which in political lingo is often lost in translation.

- Specifics: While kids are busy saving up for the latest video game, the masterminds in charge think it’s playtime with the nation’s piggy bank. The proposed cuts would reduce revenue for programs that—brace yourself—actually benefit people, which in political lingo is often lost in translation.

- Fiscal Responsibility or Fiscal Fairy Tale?: The narrative gives ‘fiscally responsible’ a whole new meaning—it apparently now means digging through the couch cushions for spare change to fund vital programs.

- Specifics: You’ve got to admire the creativity here. It takes guts to claim you’re safeguarding the public purse while lighting a match to the cash inside of it. Who knew fiscal responsibility involved fire tricks?

- Specifics: You’ve got to admire the creativity here. It takes guts to claim you’re safeguarding the public purse while lighting a match to the cash inside of it. Who knew fiscal responsibility involved fire tricks?

- The Art of the ‘Deal’: Trading seniors’ healthcare and financial security for tax cuts is like swapping your house for a handful of magic beans. Except, in this case, the beans are also expired.

- Specifics: This isn’t so much a deal as it is a spree at the expense of those depending on these programs. The logic is similar to dieting by cutting off your limbs—sure, you’ll lose weight, but good luck clapping.

- Specifics: This isn’t so much a deal as it is a spree at the expense of those depending on these programs. The logic is similar to dieting by cutting off your limbs—sure, you’ll lose weight, but good luck clapping.

- Let Them Eat Cake, Just Not Too Much: This policy caters to the Marie Antoinette school of thought. As it turns out, those at the top looking down must think cake is a suitable substitute for healthcare and a stable retirement.

- Specifics: The idea is, as long as the well-off get a tax cut, it’s a ‘let them eat cake’ moment for everyone else. The less fortunate gets to nibble on the crumbs of the safety net that’s left behind.

- Specifics: The idea is, as long as the well-off get a tax cut, it’s a ‘let them eat cake’ moment for everyone else. The less fortunate gets to nibble on the crumbs of the safety net that’s left behind.

- “It’s the Economy, Stupid”: Except, in this rendition, it’s more like it’s the stupidity, economist. Tanks to the economy by jeopardizing consumer spending when people eventually have no retirement funds left to spend.

- Specifics: The playbook here seems to misplace the chapter on constructing a robust economy. Instead, it flips directly to the section on how to dismantle one with the precision of a toddler performing brain surgery.

- Specifics: The playbook here seems to misplace the chapter on constructing a robust economy. Instead, it flips directly to the section on how to dismantle one with the precision of a toddler performing brain surgery.

The Counter

- Sure, Who Needs Retirement?: Who wouldn’t want to spend their golden years busing tables? Retirement is so last century, anyway. All the cool kids are working till they’re 90.

- Counter-Specifics: If we’re looking to model the new work-till-you-drop program, let’s start with Congress. They can show us how it’s done.

- Counter-Specifics: If we’re looking to model the new work-till-you-drop program, let’s start with Congress. They can show us how it’s done.

- Healthcare is Overrated: Besides, who even gets sick these days? Modern ailments are nothing a good ol’ fashioned walk-it-off mentality can’t fix!

- Counter-Specifics: Let’s propose a new healthcare plan: If you can’t afford it, just don’t get sick! Problem solved.

- Counter-Specifics: Let’s propose a new healthcare plan: If you can’t afford it, just don’t get sick! Problem solved.

- Invest in Bitcoin, Not Social Security: Clearly, digital currency is the way forward. Forget about dependable government programs—let’s all put our life savings into something that fluctuates more than my blood pressure at a political rally.

- Counter-Specifics: Who needs the FDIC when you’ve got the thrill of potentially losing all your money overnight? It’s like Vegas, baby, but for your pension!

- Counter-Specifics: Who needs the FDIC when you’ve got the thrill of potentially losing all your money overnight? It’s like Vegas, baby, but for your pension!

- Education is Optional: Knowledge is power, but ignorance is bliss, right? If we can’t understand the implications of these cuts, maybe they can’t hurt us.

- Counter-Specifics: Maybe we should just stop teaching economics in schools altogether. That way, nobody can complain when the numbers don’t add up.

- Counter-Specifics: Maybe we should just stop teaching economics in schools altogether. That way, nobody can complain when the numbers don’t add up.

- The Environment Will Save Us All: As long as we can breathe, who cares about money? With a bit of luck, Mother Nature will throw us a bone and start growing money trees.

- Counter-Specifics: Let’s get those environmentalists on board. Surely, they’ve got an organic, gluten-free, non-GMO solution to the impending financial apocalypse.

- Counter-Specifics: Let’s get those environmentalists on board. Surely, they’ve got an organic, gluten-free, non-GMO solution to the impending financial apocalypse.

The Hot Take

So here’s a wacky idea from the liberal cookbook: How about we actually increase taxes on the segment of the population who can genuinely afford it? You know, the same folks who consider a yacht a ‘starter boat’.

And, stick with me now, instead of giving tax cuts to the wealthy, let’s fortify the foundations of Social Security and Medicare, so they are as sturdy as the walls of a billionaire’s gated community. Why? Because believe it or not, most people actually prefer a future where eating cat food and self-medicating with WebMD isn’t the norm.

Here’s my hot take: stop treating the economy like it’s a Monopoly game. Let’s put money back in the hands of consumers, not just so they can afford basic human rights like healthcare and a roof over their heads, but so they can pump it back into the economy.

It’s a wild concept called “the circular flow of income,” and guess what? It works. The ‘trickle-down’ effect has about as much credibility as I do as a swimsuit model, and it’s high time we stop pretending otherwise.

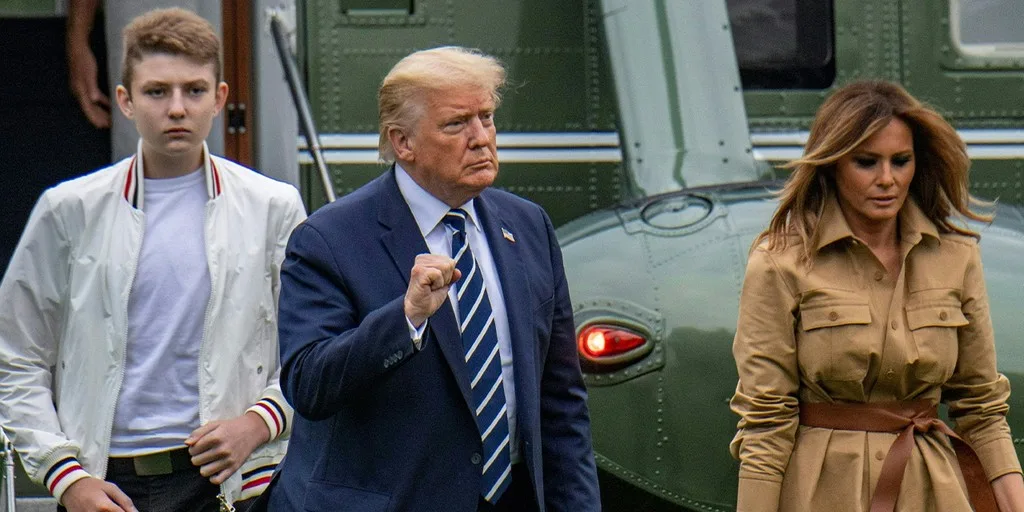

Source: Trump ‘open’ to slashing taxes that fund Social Security and Medicare: report